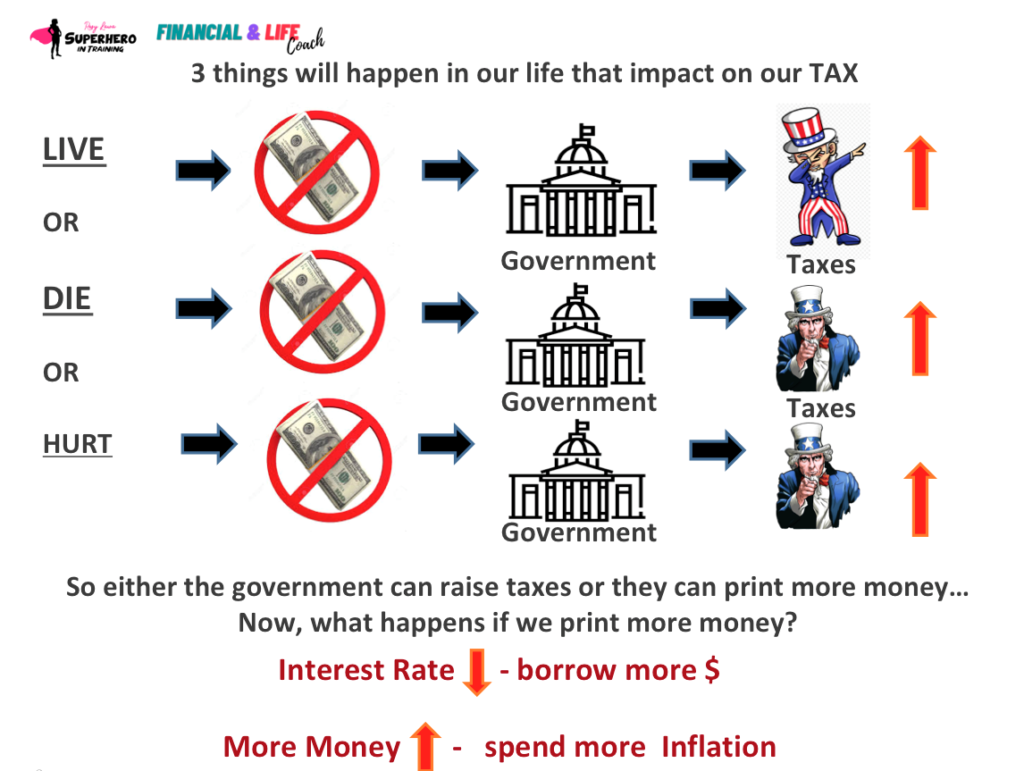

When people need Government help more like housing, disaster relief, homeless, shelters, food banks, covid vaccine, or health care ETC, then the government spends the money on those who need help. The more people depending on the Government help, government need more money because the economic causing more people need help, Government raise the tax

Government can choose either they raise the tax or print more money

When Government print more money – the interest rate going down so people can borrow more

More money borrowed thats mean more inflation

Projected annual inflation rate in the United States from 2017 to 2021

YEAR Inflation rate 2020* 0.62% 2019 1.81% 2018 2.44% 2017 2.14%

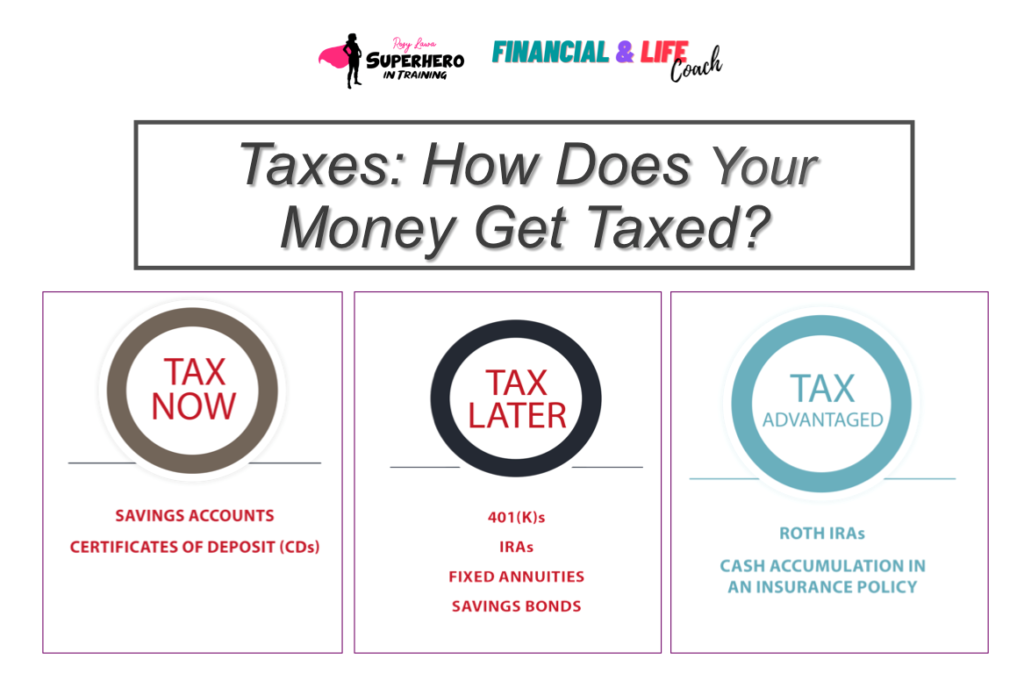

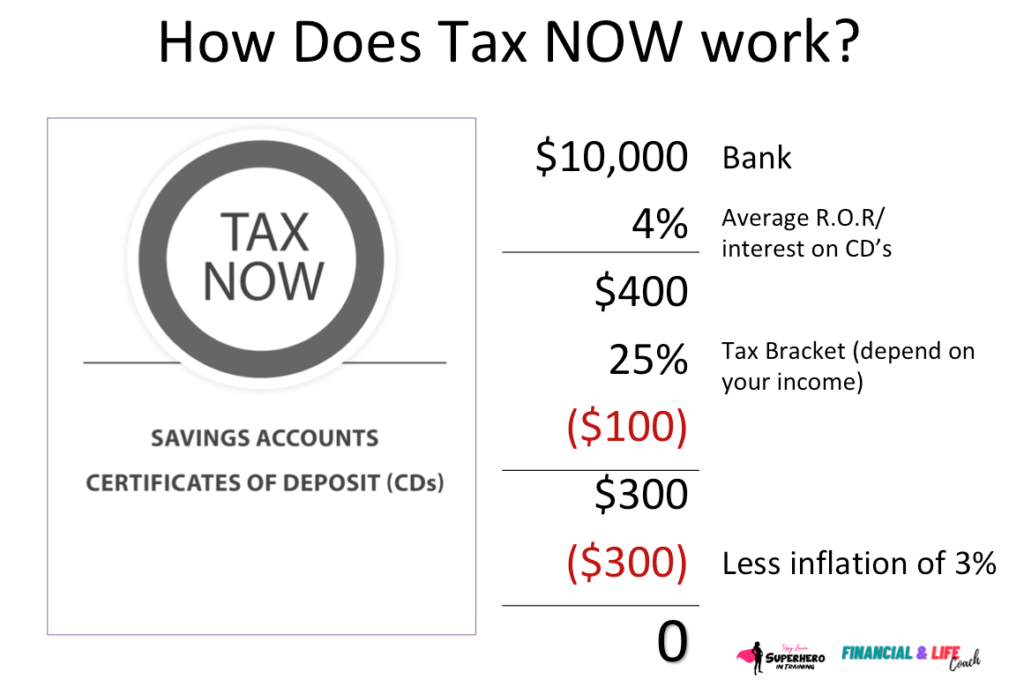

Tax Now.

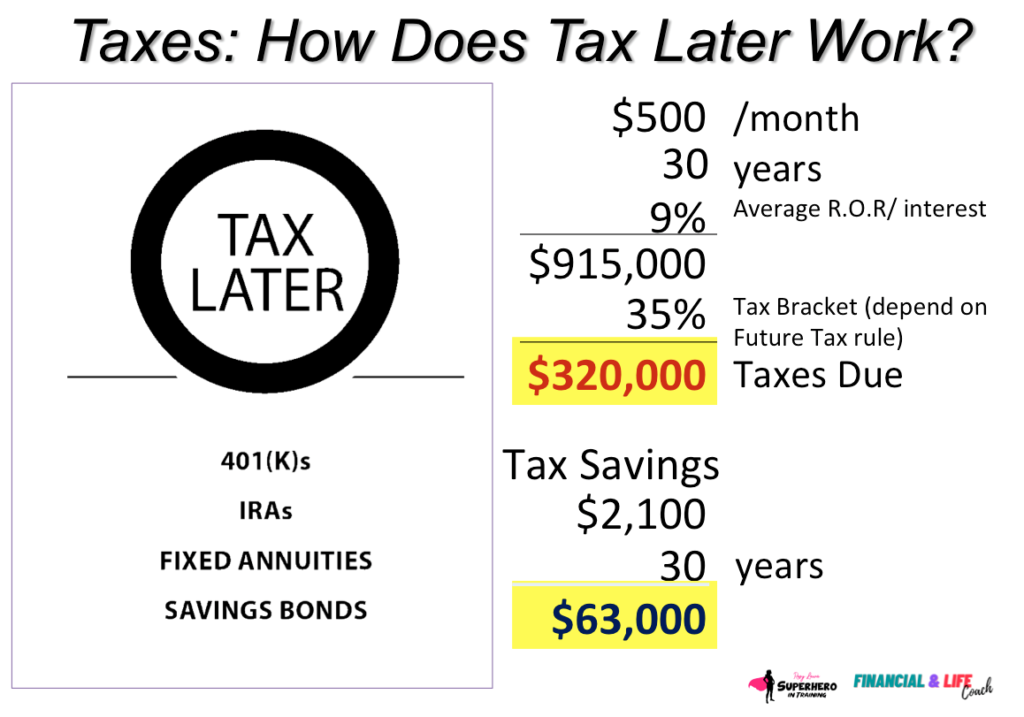

See How Much Tax settlement for the Walt Disney and Elvis Presley on TAX LATER

Tax Never.

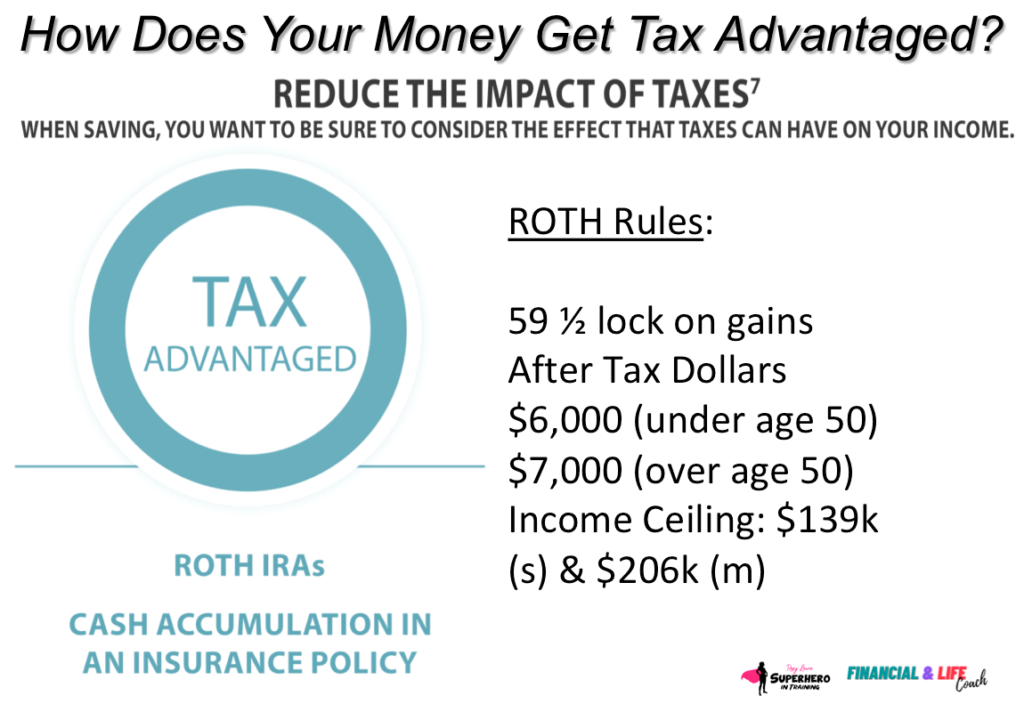

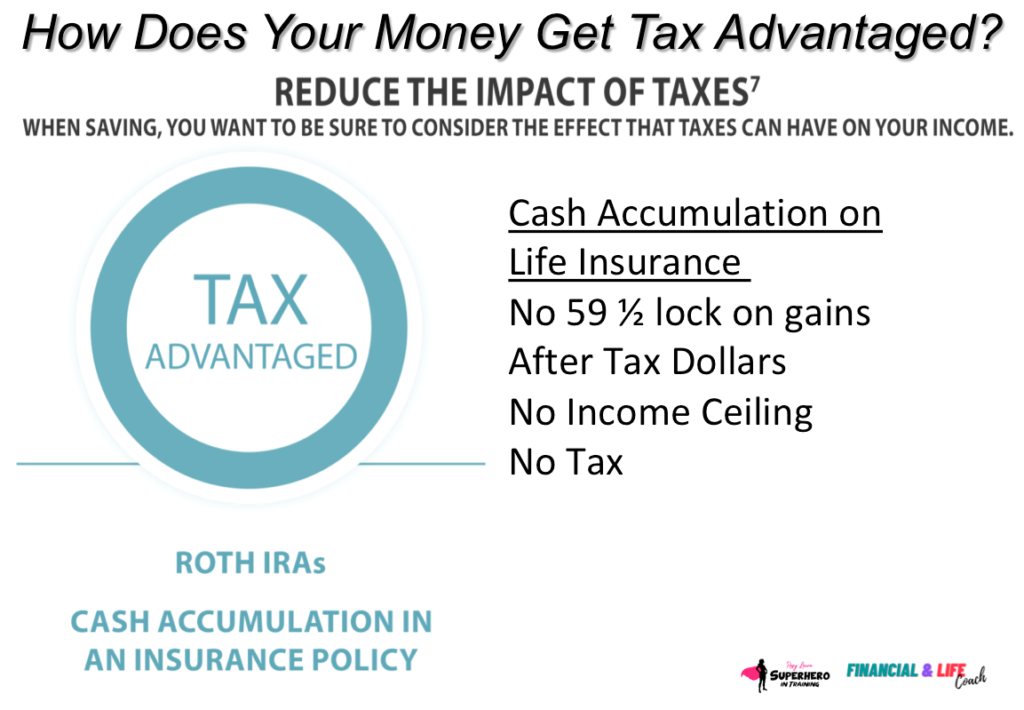

COMPARE TO

No one bucket is the be-all, end-all in financial planning and wealth management. In fact, since there’s a lot of life to live between tax now and 59½ years of age, diversification is a must. After 59½ diversification remains important, to provide sufficient liquidity and to preserve wealth. At the end of the day, a good financial plan – one that takes the long view into perspective, focusing on saving, managing, anticipating, and maximizing opportunities laid out by tax laws – is vital in ensuring long-term success and financial independence.

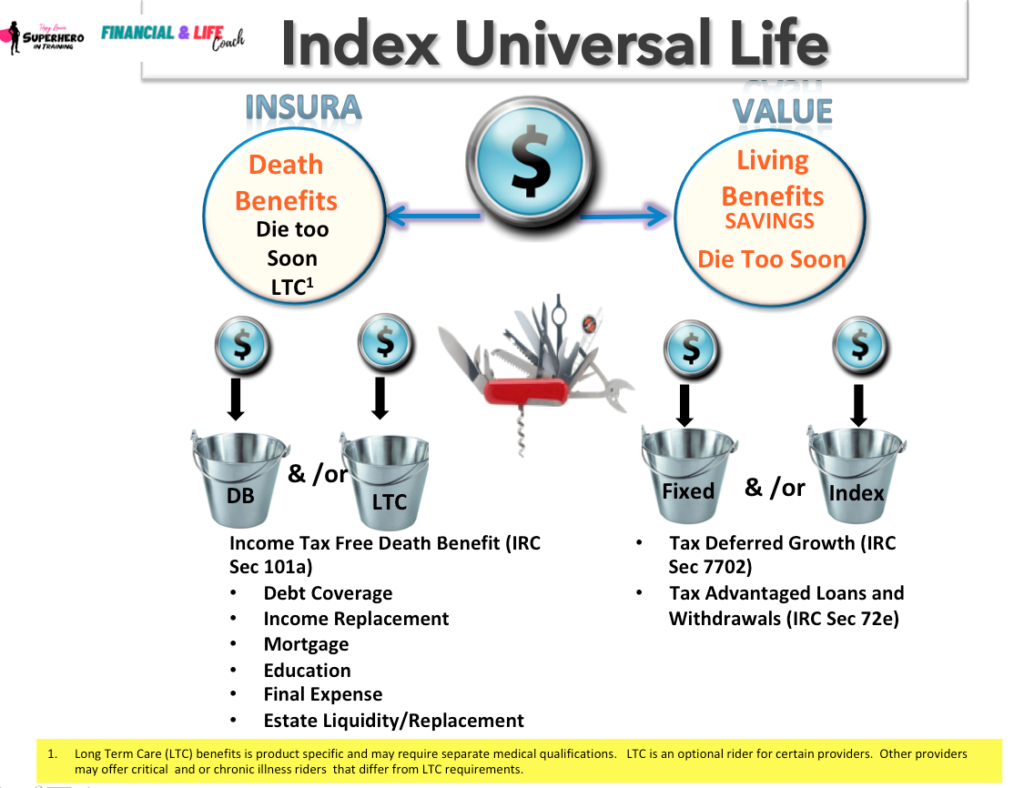

One of the perks of a life insurance policy is that the death benefit is typically tax-free. Beneficiaries generally don’t have to report the payout as income, making it a tax-free lump sum that they can use freely.

The most cost-effective way to protect their retirement savings

These days, most clients, if not all, are highly concerned about rising taxes and future market fluctuations eroding their retirement savings. Indexed Universal Life Insurance is a cost-effective way to protect their savings from taxes while providing them with supplemental retirement income for their entire lifetime.

There’s another benefit that warrants a mention here. With an IUL, your clients are in control of their own retirement savings and taxes, not their fund managers.

Feel free to contact me for a free 30 minutes consultation session if you want to to achieve your life and financial goals. You can email me rosy@superherointraining.com or text me at 818 588 6021

My name is Rosy, I am a Life and Financial Coach. As I am successfully managing my life and finances, I am passionate to help you in achieving your life and financial goals.

If you liked this video and you thought it helped you, please subscribe to the channel so I can continue growing it. And if there’s a topic you want me to cover, please let me know in the comment section below.

Subscribe To My Channel Here: https://www.youtube.com/channel/UCbqtKL5pKsp1aaJ6Sqwe7ew

Check Out My website Here: http://superherointraining.com

#AmericanTax #Tax #tax-time #financialfreedom #financial #financialtimes #financialplanning #financialeducation #financialliteracy #financialdistrict #FinancialAdvisor #FinancialServices #financialadvice #FinancialMarkets #financiallyfree #financialindependence #financialgoals #financialdomination #FinancialPlanner #FinancialHelp #financialpeace #financialsecurity #FinancialSuccess #FinancialFreedomGrant #financialcoach #financialplan #financialfitness #FINANCIALNEWS #financialpeaceuniversity #financialaid #financially #financialadviser #leavelegacythatlast #eliminatedebt #increasecashflow #longterminvestment #financialfreedom #financialindependent #financials #Lifecoach #superherointraining #leavelegacythatlast #bethechange #beahero #financialcrashcourse#taxefficiency #Taxnow #taxlater #taxnever #Taxbasic #Taxefficiency #inflation #borrowmoney #interest #printmoremoney #govermenthelp #medical #befinancialliteracy#tax

DISCLOSURE:

Superhero in training / Rosy lawa & Affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only based on personal experiences and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.